SP500 LDN TRADING UPDATE 10/2/26

SP500 LDN TRADING UPDATE 10/2/26

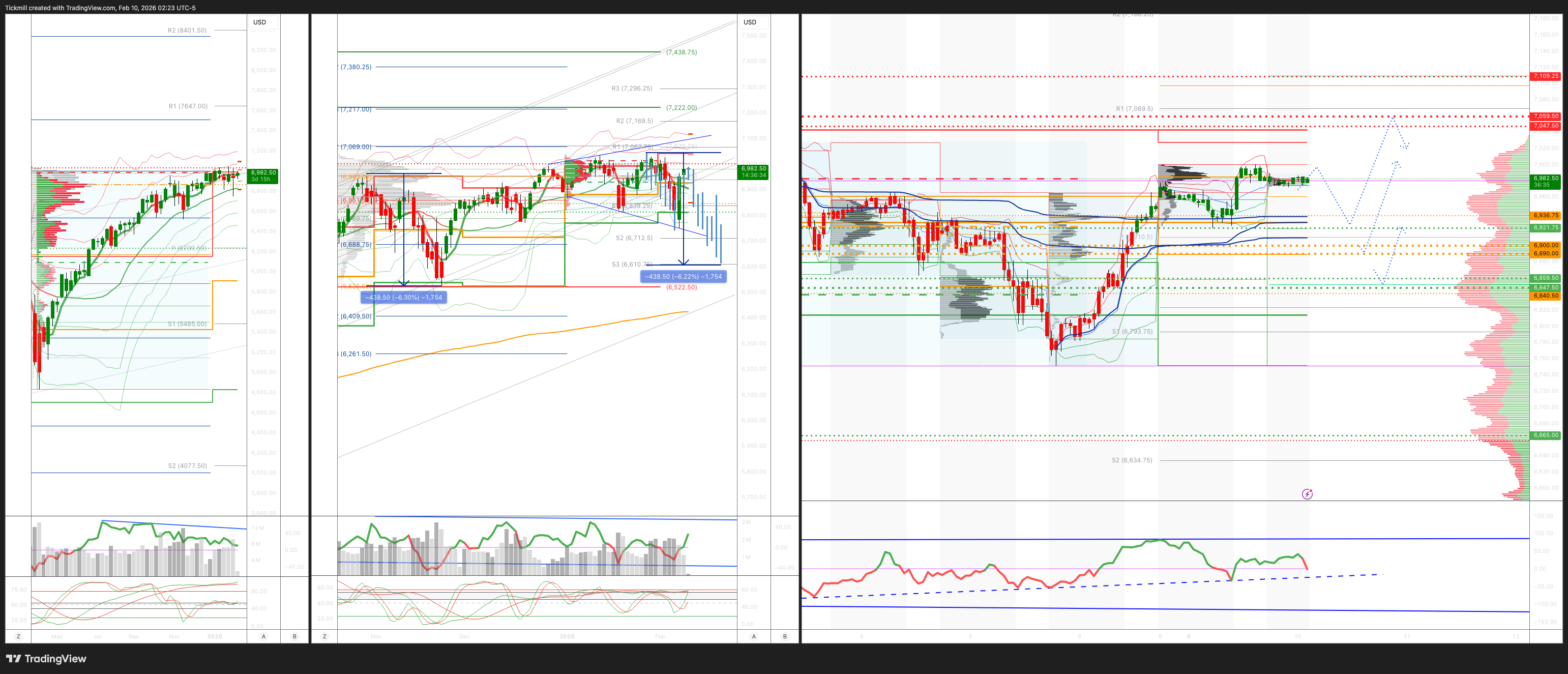

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6900/6890

WEEKLY RANGE RES 7059 SUP 6847

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

GAMMA FLIP LEVEL 6913

DAILY VWAP BULLISH 6898

WEEKLY VWAP BEARISH 6959

MONTHLY VWAP BULLISH 6865

DAILY STRUCTURE – BALANCE - 6965/6801

WEEKLY STRUCTURE – BALANCE - 7031/6801

MONTHLY STRUCTURE – TBC

DAILY BULL BEAR ZONE 6935/25

DAILY RANGE RES 7047 SUP 6921

2 SIGMA RES 7109 SUP 6859

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.1 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

SHORT ON REJECT/RECLAIM OF WEEKLY/DAILY RANGE SUP TARGET 6985

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “Calm”

S&P closed +47bps at 6,965 with a Market-on-Close (MOC) of $2.35bn to SELL. NDX gained +77bps to 25,268, R2K rose +70bps to 2,689, and the Dow edged up +4bps to 50,136. Trading volume totaled 17.76b shares across all US equity exchanges, slightly below the YTD daily average of 19.5b shares. VIX dropped -225bps to 17.35, WTI Crude climbed +135bps to $64.42, US 10YR fell -1bp to 4.20%, gold surged +203bps to 5,065, DXY declined -77bps to 96.88, and Bitcoin slipped -29bps to $70,455.

The week started on a calm note with minimal headlines as the market continues to digest last week's volatile trading, marked by significant momentum swings, weak performance from the Magnificent 7 stocks, and a crypto sell-off. Software stocks rebounded +3%, with limited supply noted on our desk compared to heavy selling pressure last week, particularly Thursday afternoon following the Anthropic update. BUY tickets are picking up as the sector shows signs of stabilization.

Looking ahead, a busy data week includes Retail Sales, NFP, and CPI. For NFP (Wednesday), Goldman Sachs economists estimate payrolls rose by 45k in January, below the consensus of +70k and the two-month average of +53k. Private payrolls are projected to have increased by 45k, also below the consensus of +75k and the two-month average of +44k.

Activity on our floor was rated a 4 on a 1-10 scale. The floor finished +687bps to buy versus a 30-day average of -95bps. Asset managers and hedge funds ended as net buyers, adding +$1b, driven by strong demand in tech (particularly software) and macro trades, while supply in financials remained relatively low. Insurance brokers weakened following news of 'OpenAI approving the first insurer-built AI app on ChatGPT,' creating uncertainty about its broader implications. After-hours, ON fell -7% despite an inline quarter, as guidance for March quarter revenue was revised down ~3% q/q at the midpoint (flat to -6% q/q).

CTAs are modeled as sellers of S&P futures this week across all scenarios, with estimates ranging from -$800mm in a flat market to -$11.2bn in a significant downturn. However, this is being offset by increasing corporate buyback activity, with 65% of S&P companies currently in their open window, growing to 75% by week's end. Our desk noted a +40% WoW increase in activity last week, particularly in tech demand.

In derivatives, the week began quietly, continuing Friday’s equity rally. Dealers added ~$1.6bn in length during Friday's rally, pushing the market back into peak long gamma territory. Short-dated SPX call vols returned to single-digit levels, while June-dated SPX vols also began easing. The panic index stabilized at 7.50, down from last week's spike above 9. The desk sees value in owning short-dated topside options now that the vol surface has reset to pre-volatility levels. Interest was noted in longer-dated SPX upside and rolling Magnificent 7 upside positions. SPX daily straddles normalized to the 40-50bps range, reflecting a return to stability after last week's chaos. Tomorrow's straddle closed at ~47bps. (h/t Shayna Peart)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!