Institutional Insights: Nomura 'Nasty S&P Backtest'

Market Overview:

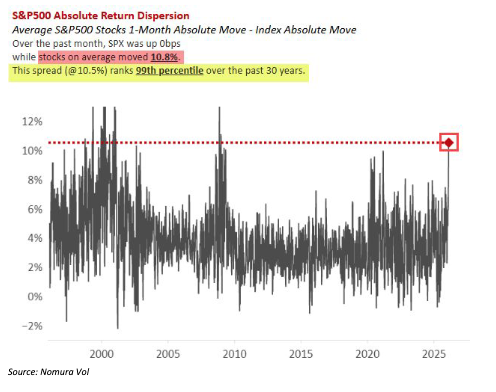

The index appears calm, but individual stocks show significant volatility. Historically, such extremes often precede negative S&P 500 returns 2-3 months later, even if the short-term outlook seems stable.

---

1) Rates: Labor Market Concerns

- Market Behavior: USTs/SOFR suggest the market is short duration/rates, creating vulnerability to sudden moves.

- Drivers of Nerves: Weak labor data (JOLTS, ADP), potential payroll revisions, and admin commentary hinting at weakness.

- Options Signal: Heavy skew to OTM receivers reflects fears of labor shocks leading to growth concerns and falling yields.

Takeaway: Rates markets are pricing in labor downside risks, signaling potential bond rallies.

---

2) Equities: High Dispersion, Low Correlation

- Key Observations:

- SPX flat since mid-Jan, but average stock moves ~10.8%.

- Low correlation (~9) boosts dispersion (idiosyncratic moves) and suppresses index volatility.

- Outcome: Violent single-stock swings offset each other, making the index appear calm.

3) Causes of Dispersion:

1. Factor Rotation: Shift from Mag7/AI to Value/Cyclicals/Defensives.

2. Crowded Positioning: High leverage and rapid de-risking in multi-manager strategies.

3. Options Impact: Short-dated options and leveraged ETFs amplify single-stock moves.

---

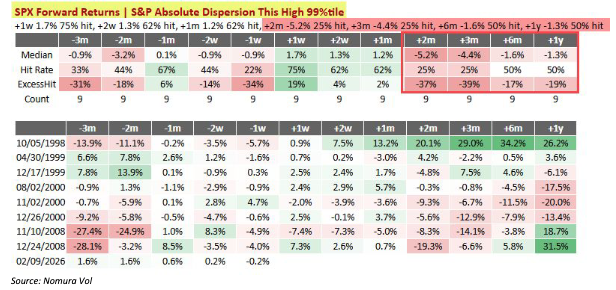

4) Historical Warning:

- Extreme dispersion (~99th percentile) historically leads to:

- t+1 month: Stable returns.

- t+2 to t+3 months: Median SPX returns turn negative, with potential drawdowns.

- 1 year: Returns remain weak.

- Dispersion often signals unstable positioning and macro stress, which can resolve with broader risk-off moves.

---

5) Trading Takeaways:

- Don’t be misled by SPX calm; watch for delayed downside after extreme dispersion.

- Dispersion trades (long single-name vol/short index vol) have worked during these periods.

- Be cautious of correlation snapping back during risk-off events, which could spike index volatility.

---

Key Points Summary:

- Rates: Hedging labor downside risk; fear of yields dropping on growth concerns.

- Equities: Index calm masks extreme single-stock dispersion.

- History: Extreme dispersion often precedes negative SPX returns 2-3 months later.

- Risk: Correlation shifts during risk-off could trigger rapid index volatility.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!