SP500 LDN TRADING UPDATE 11/2/26

SP500 LDN TRADING UPDATE 11/2/26

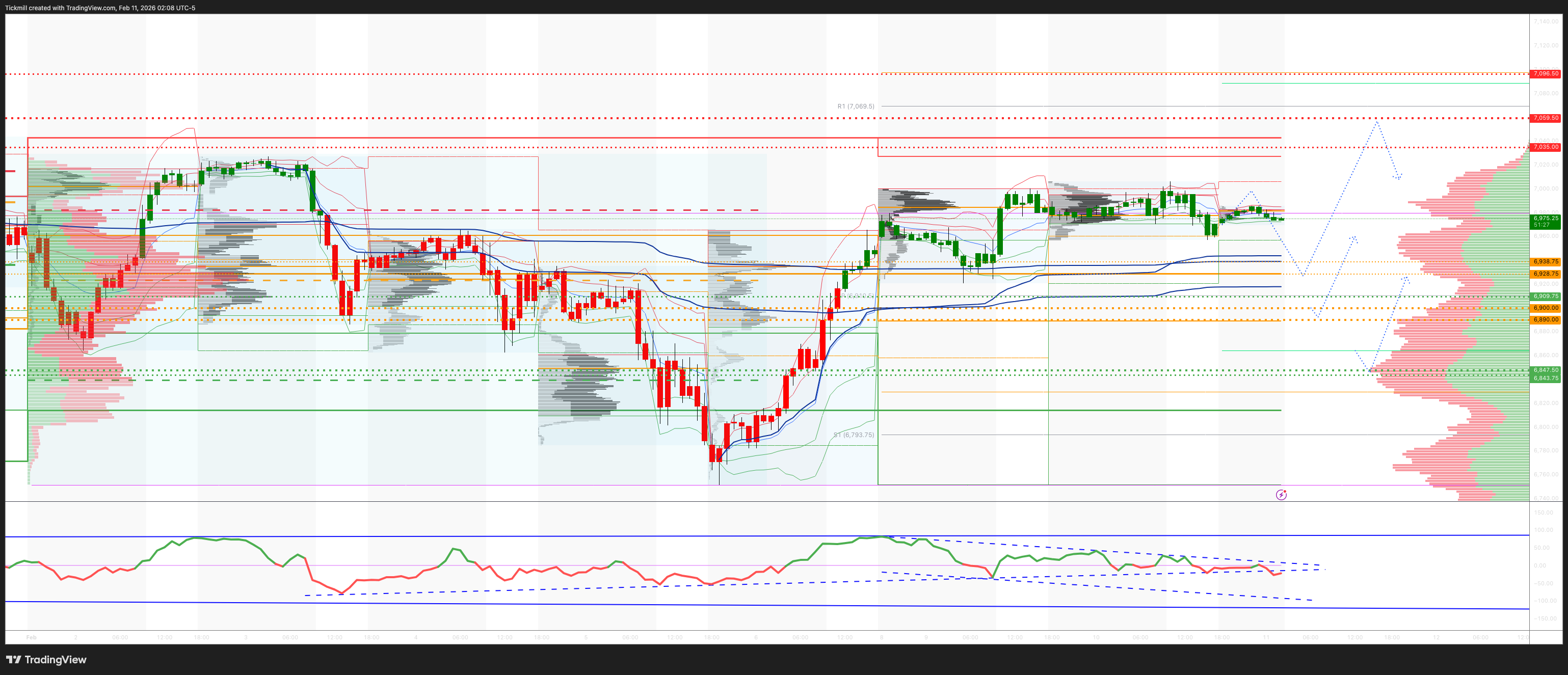

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6900/6890

WEEKLY RANGE RES 7059 SUP 6847

FEB OPEX STRADDLE 6726/7154

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

GAMMA FLIP LEVEL 6939

DAILY VWAP BULLISH 6914

WEEKLY VWAP BEARISH 6967

MONTHLY VWAP BULLISH 6901

DAILY STRUCTURE – ONE TIME FRAMING HIGHER - 6957

WEEKLY STRUCTURE – BALANCE - 7031/6801

MONTHLY STRUCTURE – TBC

DAILY BULL BEAR ZONE 6938/28

DAILY RANGE RES 7035 SUP 6909

2 SIGMA RES 7096 SUP 6847

VIX BULL BEAR ZONE 20

PUT/CALL RATIO 1.2 (The numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish)

TRADES & TARGETS

LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON REJECT/RECLAIM OF WEEKLY/DAILY RANGE SUP TARGET 6985

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

JPMORGAN TRADING DESK VIEW - ‘Data As A Catalyst’

Equities faded after a two-day bounce as weak Retail Sales and profit-taking hit, rates bull-flattened hard on softer-growth fears, and now the entire macro narrative hinges on NFP first and CPI second. JPM’s desk framing is that the market’s break-even for payrolls is drastically lower than prior years because population growth has downshifted, so “Goldilocks” is a narrower band than people think, with unemployment rate and the rate-curve reaction doing most of the damage or healing. Into that, positioning is described as light with a prior steepener consensus that is now unwinding, while on the equity tape AI/software is rebooting, momentum is getting de-grossed, and several defensive/squeeze dynamics are showing up (utilities and healthcare) without clean headlines

NFP: the distribution is tight, but tails matter more than usual

Feroli’s base case is soft: 75k jobs, unemployment 4.4%, AHE 0.3% MoM / 3.6% YoY. Desk scenario analysis says the “happy zone” for SPX is roughly 60k–110k, where the index is expected to be modestly up, but both tails are negative: too hot pushes yields up and hits stocks; too cold raises “Fed late” anxiety and can also hit risk. Their key nuance is the implied NFP break-even may be near ~30k now (versus ~250k in 2023), which is a major regime shift in how the market will judge “good enough.” Options are pricing about a 1.2% move for the immediate expiry window they cite.

CPI: core MoM is the real trigger, skewed to hawkish risk

Feroli expects a firm print: headline 0.35% MoM (2.5% YoY) and core 0.39% MoM (2.6% YoY). The desk’s CPI scenarios are centered on core MoM, with the “best” equity outcome in the 0.30%–0.35% range (SPX +1% to +1.5%), while an upside surprise above 0.45% is the clear risk-off outcome (SPX -1.25% to -2.5%). They explicitly say a hawkish print is more likely than a dovish one, but they don’t expect a clean “stagflation playbook” rotation; instead they see a messier rebalance where secular growth/megacap tech/healthcare can still hold up relative even if cyclicals wobble. Options are pricing about a 1.1% move into Friday around the CPI window, per their note.

Cross-asset and tape: rates are front-running softer growth; equities are rotating, not trending

Rates saw a notable bull flattening, attributed to weak Retail Sales plus mounting “softer labor” chatter into NFP, and amplified by light positioning and an unwind of steepener bias. The equity tape is described as rotational: software demand is returning as selling pressure fades, AI-linked “levered OpenAI” proxies are snapping back, while momentum is getting hit (covering shorts and selling longs). Defensives are quietly bid: utilities had a large rally explained partly by rates and partly by how low positioning is, and healthcare/med tech looks “squeezy” rather than fundamentally flow-driven.

The note is effectively saying the next two prints decide whether this is a relief-rally continuation or another volatility spike. For NFP, watch unemployment rate and how the back end trades on the release; a benign payroll number that still lifts yields is not “Goldilocks.” For CPI, the key is whether core lands in the 0.35%–0.40% neighborhood versus drifting into the 0.40%–0.45% hawkish band; the former supports the rotation into secular growth/software, the latter reopens index-downside with rates vol doing the heavy lifting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!